is pre k tax deductible

No tuition for kindergarten isnt a qualifying expense for the child and dependent care credit because expenses to attend kindergarten or a higher grade are educational. Is Private School Tuition Tax Deductible.

Is Preschool Tuition Tax Deductible Motherly

That doesnt necessarily mean you cant still get some money.

. Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. First and foremost you should know that preschool tuition isnt technically tax deductible. Ordinarily a taxpayer can only confer 16000 a year for 2022 15000 for 2021 to each grandchild or anyone else for that matter without triggering.

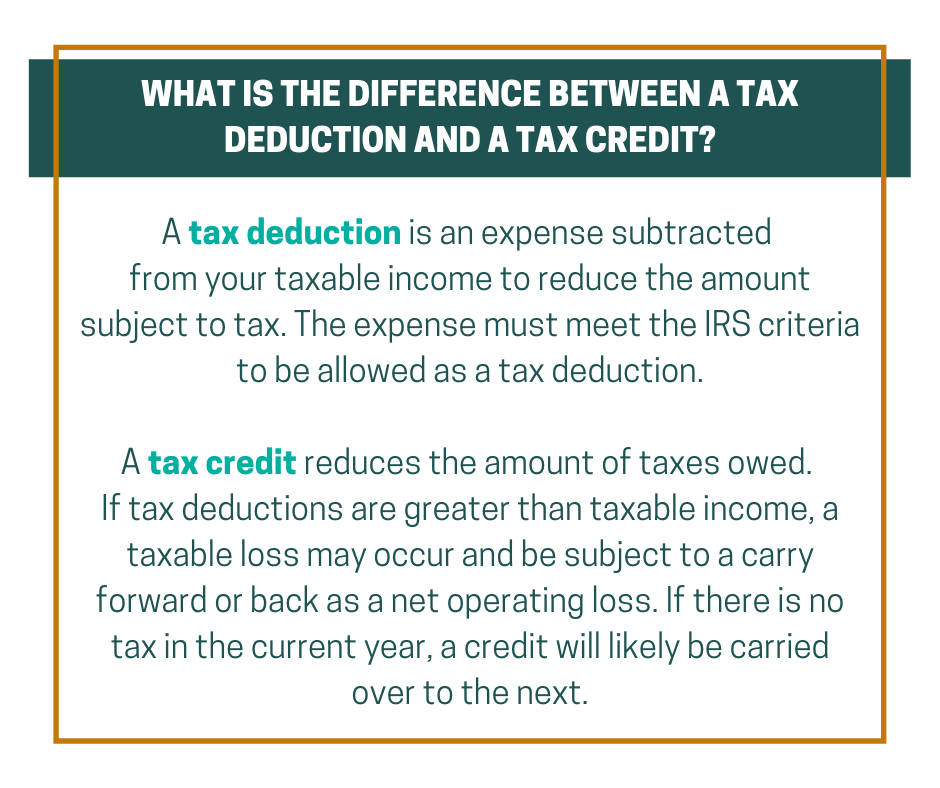

Tax deduction or credit. Some of the most common questions we get are Is private preschool tax deductible and Is catholic school tuition tax deductible In both of these cases the answer will always be no. A credit called the Child and Dependent Care.

The IRS does not offer tax breaks for the education expenses incurred for students in kindergarten through high. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. If your employer offers a tax-deferred flexible spending account you may be able to divert 5000 to childcare.

A credit called the Child and Dependent Care. Nursery school and other prekindergarten costs generally qualify for the Child and Dependent Care Credit because the educational benefits are considered incidental to the child care costs. A deductible expense is the one you can subtract from your income to reduce your tax liability.

Routing the expenses through the FSA account will have the same effect as a tax. Assuming you meet these. The Gift-Tax Exemption.

Typically preschool expenses were only counted toward a child and dependent care credit and not a education credit or. If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you could claim a tax credit of either. The good news is this can apply as a child and dependent care credit.

The tax benefit that you may be able to receive for preschool tuition is the Child and Dependent Care Expenses tax credit. Nursery school preschool and similar pre-kindergarten programs are considered child care by the IRS. Although preschool expenses do not qualify as a tax deduction on their own right you can claim them as part of the child and dependent care credit assuming you qualify.

Tax credits also directly reduce your tax. Preschool fees are generally not tax-deductible from a parents taxes. Kindergarten costs are generally not eligible for any tax credits or deductions.

Is preschool tuition deductible. By Katherine Hutt Scott. Additionally you might consider.

This tax credit is designed to help taxpayers who. Tuition is not deductible on federal income taxes but parents have other options to reduce costs. Preschool fees are generally not tax-deductible from a parents taxes.

You can claim the part of pre-k. Summer day camps also count as child care. Is there tax relief for preschool parents.

Letter Requesting Donations For Silent Auction Download This Silent Auction Donation Reques Donation Letter Donation Letter Template Donation Request Letters

Can I Claim Expenses For Preschool As A Tax Deduction

Is Life Insurance Tax Deductible Permanent Life Insurance Tax Deductions Life Insurance

Are Closing Costs Tax Deductible Nextadvisor With Time

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

The Professional Development Tax Deduction What You Need To Know

Is College Tuition Tax Deductible Yes It Can Be

When Is Interest On Debt Tax Deductible

Tax Credits Deductions For Your Transportation Business

Is Kindergarten Tax Deductible H R Block

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Pre Tax Vs Post Tax Deductions What Employers Should Know

Are Montessori Preschool Expenses Tax Deductible Hill Point Montessori

Please Consider Making A Tax Deductible Donation To Help Maintain This Website And Also Fund Our 8th Grade Form Drawing Chalkboard Drawings Folder Cover Design

Is Tuition Reimbursement Taxable A Guide Cleardegree

Retirement Planning An Infographic How To Plan Retirement Planning Retirement

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Fish Theme Preschool Classroom Lesson Plans Preschool Lesson Plans Kids Learning Activities Preschool Lessons